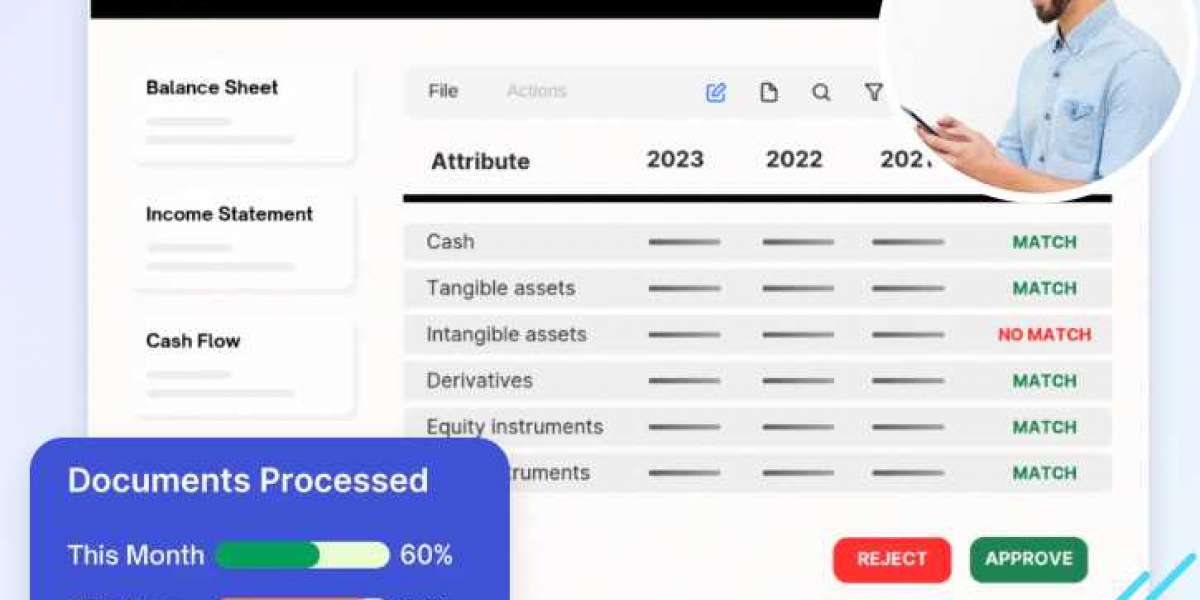

Spreading finance refers to the systematic process of organizing and analyzing financial statements to evaluate a company’s creditworthiness. This essential task in banking and lending involves extracting key financial data—like income statements, balance sheets, and cash flow statements—and reformatting it into standardized templates. By spreading finance, credit analysts can easily compare financial metrics across time periods and companies, enhancing risk assessment accuracy. Modern software tools and AI-driven platforms have further streamlined this process, reducing human error and increasing efficiency. Whether for small businesses or large corporations, spreading finance supports better-informed lending decisions and regulatory compliance. As financial institutions face rising volumes of data, automation in finance spreading is becoming a vital asset for accurate, fast, and scalable analysis.

Поиск

популярные посты